Income and Expenses

The two main parts of your cash flow are your income and expenses. However, understanding your cash flow is about more than just knowing how much is coming in, and how much is going out. Here is what you need to know:

The two main parts of your cash flow are your income and expenses. However, understanding your cash flow is about more than just knowing how much is coming in, and how much is going out. Here is what you need to know:

Income: You should know how much you have coming in, but you also need to know the source. Is your income from a regular job? A side hustle? Income investments? Additionally, you should know when you receive your income. If you know that you will be paid $2,000 every other week from your job, and that you will receive $300 on the 15th from a quarterly dividend payout, that matters. When you receive your money is just as important how much you receive.

Expenses: Likewise, you also need to know when payments need to be made. Understanding when your bills are due, and when you need to schedule debits from your account, or write checks is vital if you want to avoid late payment fees. It is also important to be aware of how you are spending your money so that you can identify money leaks, and reduce the amount of waste in your household.

Take the time to track your income as it moves through your personal economy and is used to pay your obligations. Look for patterns in your spending, and find ways to ensure that more money is going toward the most important things, such as retirement accounts and paying off debt.

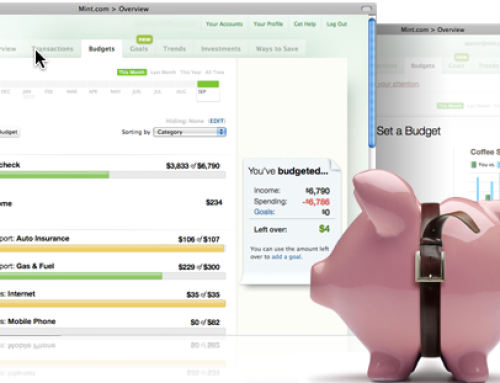

An easy way to help you understand your monthly cash flow is to use personal finance software. There are plenty of free applications available online that can help you track your income and expenses. Periodically review the results, using tools like reports and graphs, to help you visualize where your money is going. You can also create your own financial map to show what is happening with your money. This should include information about what account your money is deposited in, and any automatic debits, such as those made to investment accounts. If you have multiple accounts, make sure that you know which account is being used for which expenses.

Also, match up when your money comes in with when your bills are due. Plan your finances so that the expenses that are due within a pay period are covered by that particular paycheck. You can also look ahead and schedule your payments to better match up to when you are paid. Understanding your cash flow can help you see where you need to improve, and can even help you improve the way money moves through your personal economy so that you build your wealth more effectively.

Follow Us