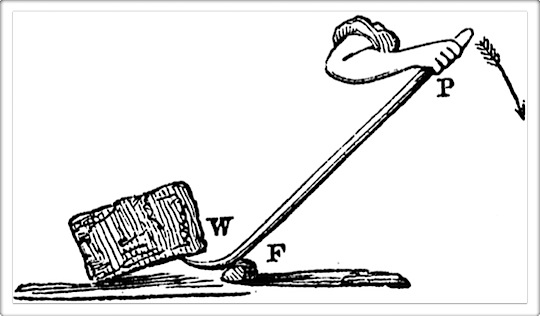

“Give me a lever long enough and a place to stand and I will move the entire earth.”

“Give me a lever long enough and a place to stand and I will move the entire earth.”

Archimedes (c. 287-212 B.C.)

In the world of finance and investing, leverage is used as a way to increase the potential return on investment. Basically, you borrow money in order to get more than you normally would be able to buy. The concept of debt leverage is quite often seen in the case of buying a home. You make a down payment, and then borrow the rest. You are able to, as a result, purchase an asset that is worth far more than you have the capital to buy on your own.

How Leverage Works When You Buy a Home

A very simple illustration is as follows: You purchase a $200,000 house with a 10% down payment of $20,000. This represents leverage of about 10:1. The cost of interest for that first year (on $180,000), at 4% is $7,200. Let’s say that the home appreciates by $12,000 in one year. You figure your rate of return by dividing the increase by your down payment plus your interest, so 12,000/(20,000 + 7,200) = 44%.

Not bad, especially if you consider that if you had bought the house outright (no leverage used at all), your rate of return would be 12,000/200,000 = 6%. You can see that using a little leverage can lead to better returns — and that’s the point of leverage. You can put a down payment on your home, and hope that it appreciates, and you will have a valuable asset, and a solid return on your investment, without needing a large amount of capital.

The larger the leverage, the larger the potential for return. Consider the idea of using leverage of close to 100:1, as many people were doing in the run up to the financial crisis. Instead of putting a 10% down payment, perhaps you only put 1% down — $2,000. Now, your interest cost is higher, since you’re borrowing more ($198,000), and probably paying 6%, but that can be accounted for: 12,000/(2,000+ 11,880) = 86.5%.

Now, there’s a return! Over time, as long as the home continues to appreciate, that extra leverage nets you a larger return. You’ve truly gotten a huge bang for your buck.

The Downside to Leverage

Leverage magnifies your returns, but that’s not all it magnifies. It also magnifies your losses. Consider the examples of home ownership above. What if, instead of appreciating over the course of a year, the home depreciates? Now, the home is worth $12,000 less than when you bought it. With the smaller leverage — 10:1 — you have a better chance of absorbing that loss. First of all, you only borrowed $180,000, so the fact the home is only worth $188,000 means that you aren’t even underwater on your mortgage yet, since you’ve also been making monthly payments.

However, the larger the leverage, the larger your losses. With the leverage of 100:1, things look much worse. You borrowed $198,000, and now your home is only worth $188,000. And, because the interest payments were higher each month, not as much went toward the principal, so your balance is a little more than $195,500. You’re already underwater, and if home values fall further, your losses will pile up.

Of course, because you are over-leveraged and you owe more than your home is worth, you can’t refinance. If you try to sell, you will have to try to convince the bank to do a short sale and forgive you the difference. In the end, you might end up in foreclosure. You lose your capital, plus what you have already paid in interest (and other housing related costs), and you lose the large asset.

Banks and Leverage

As you can see from personal leverage, higher leverage means the potential for higher gains — or losses. The big banks saw leverage as an opportunity to make fabulous sums of money. Many of the big investment banks were leveraged for between 30:1 and 50:1. Fannie Mae and Freddie Mac were very close to 100:1. When you are using leverage like that, and using it on billions of dollars, the results are correspondingly huge.

Many banks bought groups of mortgages bundled into securities. Others, like Fannie and Freddie, bought mortgages from other lenders and serviced them. In order to make these purchases, the investment banks, and Fannie and Freddie, used borrowed funds — just like homeowners. However, it’s more like using a 30:1 leverage to use $1,000,000 in capital to buy $30,000,000 in mortgages. Big potential for huge gains down the road.

And huge potential for big losses. The main difference, though, is that banks felt like they could use more leverage because they could be bailed out. Investment banks went to the Fed, and received special loans to help them cover losses and the government even bought stock from some companies to help shore up balance sheets. Fannie and Freddie are government sponsored enterprises, and the assumption (that turned out to be right) was that the government would back them. So, they felt confident with their ability to take on the risk associated with larger leverage.

Bottom Line

For individuals and banks, the risks are the same, but individuals don’t have the same way out — and when the banks take such risks and they go bad, it means billions of dollars lost and economic difficulty. You can see, just from the way leverage works on an individual level, how the effects can be magnified on the level of banks.

You are better off when you use a smaller amount of leverage, keeping it to 5:1 (20% down) or 10:1, and the entire economy is better off when the big banks observe similar rules of leverage. The prospect of making fabulous amounts of money isn’t worth the risk that comes with such high leverage.

Follow Us